Not able to connect you to one of our tax professionals, we will refund the applicable TurboTax federal and/or We will not represent you before the IRS or state agency or provide legal advice.

Support Center for audited returns filed with TurboTax for the current tax year (2021) and the past two tax

#Last year tax return professional

Will provide one-on-one question-and-answer support with a tax professional as requested through our Audit Audit Support Guarantee: If you receive an audit letter based on your 2021 TurboTax return, we.Review, or acting as a signed preparer for your return, we'll pay you the penalty and interest. 100% Accurate Expert-Approved Guarantee: If you pay an IRS or state penalty (or interest)īecause of an error that a TurboTax tax expert or CPA made while providing topic-specific tax advice, a section.

#Last year tax return free

(TurboTax Online Free Edition customers are entitled to payment of Larger refund or smaller tax due from another tax preparation method, we'll refund the applicable TurboTaxįederal and/or state purchase price paid.

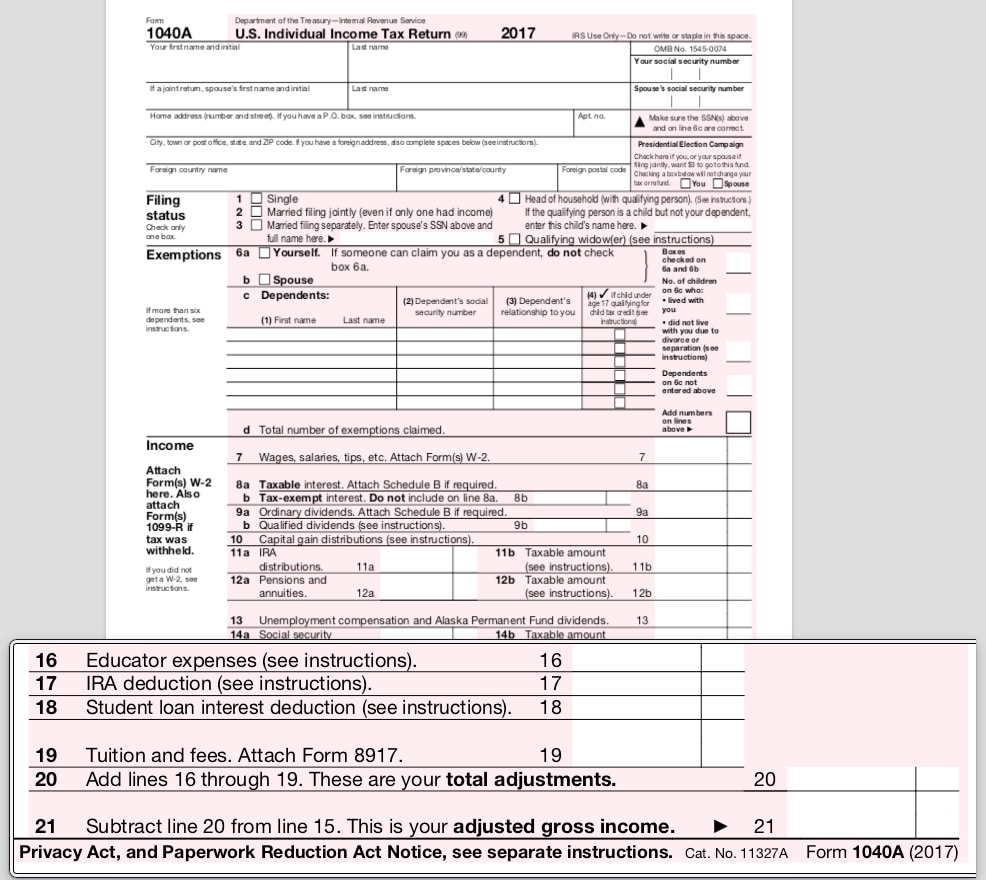

Of a TurboTax calculation error, we’ll pay you the penalty and interest. 100% Accurate Calculations Guarantee: If you pay an IRS or state penalty or interest because.View the Vice President and Second Gentleman’s tax returns here. They contributed $27,006 to charity in 2020. Emhoff paid $56,997 in District of Columbia income tax. They also paid $125,004 in California income tax and Mr. They paid $621,893 in federal income tax, amounting to a 2020 effective federal income tax rate of 36.7 percent. The Vice President and the Second Gentleman reported federal adjusted gross income of $1,695,225. Including today’s release, the Vice President has published 17 years of tax returns. The Vice President and the Second Gentleman also released their 2020 federal income tax return, as well as state income tax returns for both California and the District of Columbia. View the President and First Lady’s tax returns here. The First Lady also released her Virginia income tax return and reported paying $443 in Virginia income tax. The President and First Lady also released their Delaware income tax return and reported paying $28,794 in Delaware income tax. The largest reported gift to charity was $10,000 to the Beau Biden Foundation, a public charity dedicated to ensuring that all children are free from the threat of abuse.

The President and First Lady also reported donating $30,704 – or about 5.1 percent of their total income – to 10 different charities. The Bidens paid $157,414 in federal income tax and their 2020 effective federal income tax rate is 25.9 percent. The President and the First Lady filed their income tax return jointly and reported federal adjusted gross income of $607,336. With this release, the President has shared a total of 23 years of tax returns with the American public. Today, the President released his 2020 federal income tax return, continuing an almost uninterrupted tradition.

Office of Science and Technology Policy.Executive Offices Show submenu for “Executive Offices””.Administration Show submenu for “Administration””.

0 kommentar(er)

0 kommentar(er)